There are an estimated 60 million MSMEs in India today, which are significant contributors to employment and gross domestic product. Yet one of the biggest pain points for them has been lack of access to formal capital – having access through the informal market is further pushing these MSMEs to not perform to their potential as the interest rates are twice as high as the formal market.

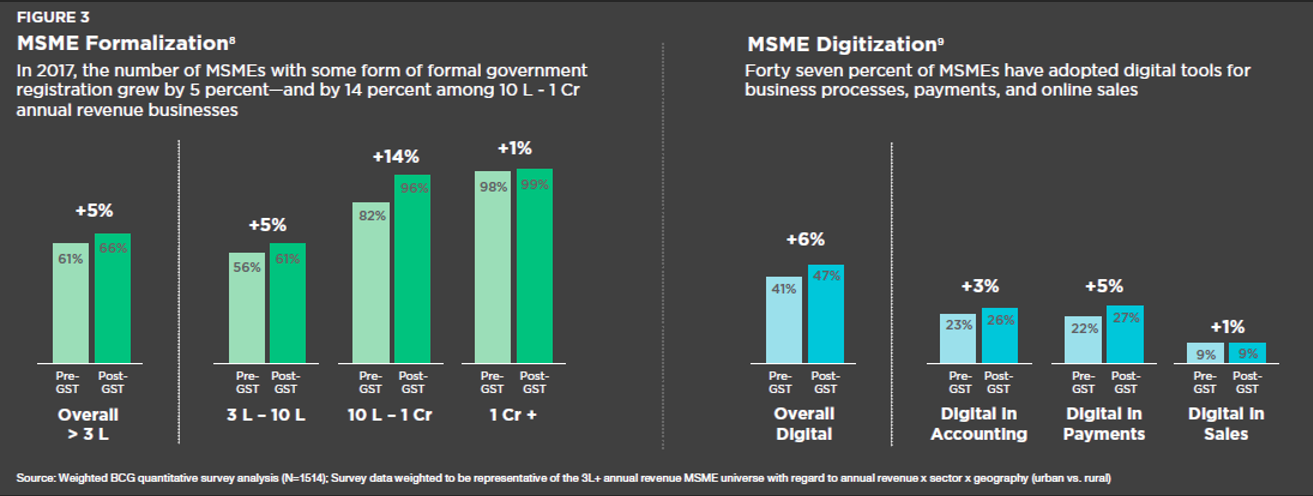

Today the MSME Sector is becoming a more attractive proposition for lenders to look into. There are several reasons for it; First, MSMEs are digitizing themselves thanks to government led initiatives like demonetization, GST, and UPI; Second, with the help of API based data availability MSME lending is rapidly moving towards end-to-end digital lending with loan approval time as short as a day; Third, an estimated 50% of the MSMEs will be making and accepting payments digitally in the coming years. Unmet customer demand and embracing digital behavior has attracted all kinds of players like incumbent banks, e-platforms, and FinTechs to the market.

Driven by government tax reform, MSMEs are rapidly becoming government registered or government licensed businesses. And thanks to the United Payments Interface launch, a real-time system for mobile transactions the economy is moving from cash dependent to a digital one. UPI combined with the introduction of GST stimulated a massive growth in digital payments across India.

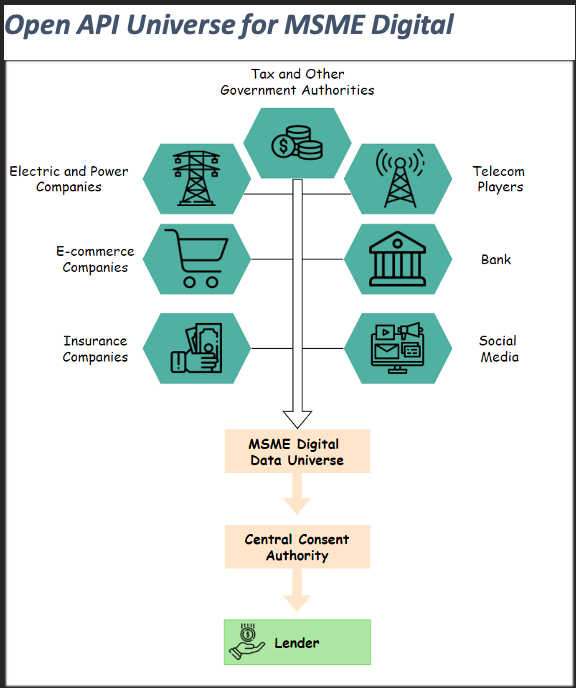

Today, it is easy to start a business digitally, you can create the entire supply chain digitally right from procurement to delivery. This leaves a massive digital trail, however, it is challenging to gather as it is not all in one place. Lenders must act creatively in getting hold of this data trail as more and more MSMEs use digital payments in the future, the trail will prove to be substantial.

In the 2018 IFC report, the overall debt demand of MSMEs is close to USD 1.1 trillion and 84% of it is financed though informal sources and just 16% or USD 168 billion through formal sources. Around 81% of the USD 168 billion is met by commercial banks and NBFCs, RRBs, UCBs and government financial institutions make up the rest. The demand met by commercial banks and NBFCs are mostly non-digital. These established players are expanding into the digital realm either by building their own lending platform ensuring control or collaborating with E-commerce digital aggregators or FinTech companies. The future of MSME lending will be understanding and predicting the performance of the business.